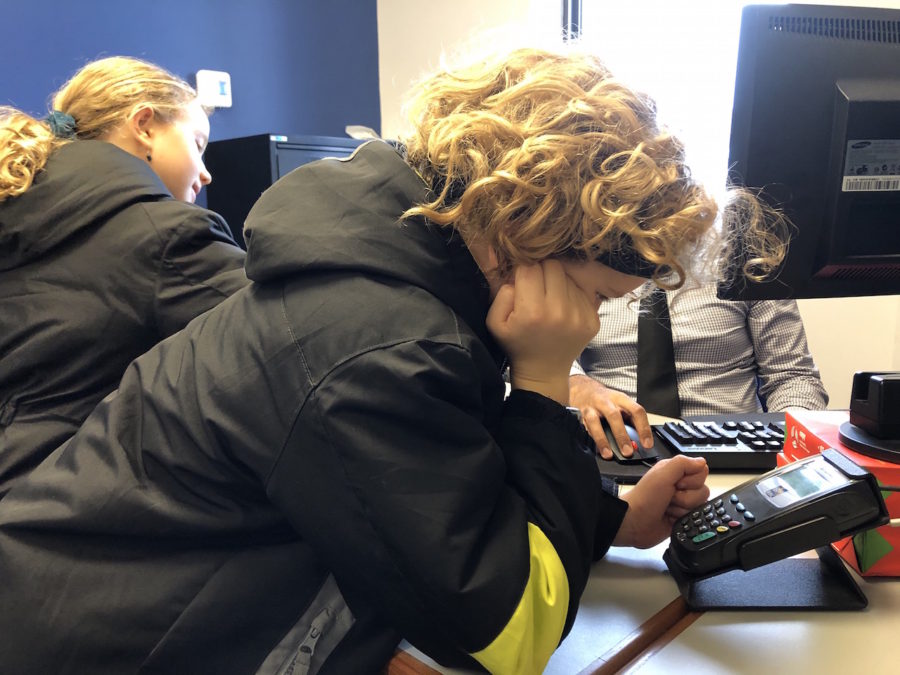

It was a big moment when we walked into the bank and opened accounts for Finley and Grace. It took over an hour but the questions they were asking were littered with learning opportunities. You can sometimes take for granted your understanding of how virtual money works. Grace wanted to change some coins into bills and then deposit them into her new account. We were perplexed as to why she wanted to change them into bills before she deposited them, we insisted that she just deposit the coins. Later we finally understood what she was saying, she was under the impression that if she deposited coins they had to come back out as coins.

Finley asked about the interest and how that worked. The concept of compound interest was discussed. The man at the bank was very patient and answered the questions well. They asked about online banking and how their card works. We later got into a discussion about our investments and retirement. We talked about credit cards versus bank cards and how that works. We talked about passwords and security. It made me really think about how we often drop the ball in schools when it comes to financial literacy. Loans, taxes, investments, mortgages, long term planning etc etc…

What programs are out there for young people learning financial literacy? please share.

Should it be required in school?

What age?

“she was under the impression that if she deposited coins they had to come back out as coins.”

I love this because it shows that kids will tell us what they need to learn if we make them feel safe and lead them through genuine diagnostics. All of us are afraid to look silly so we conceal our ignorance—this is especially true for younger people, I suspect. Based on Grace’s statement, I’d say we need to start financial education in ES beginning with how barter trade gave way to fiat currency as civilization developed. Now, more that ever, with cryptocurrency about to take over, we need to know that money is a psychological construct.

Password security may be the most important lesson all of us need to learn: most hacks arise from compromised passwords. Even though passwords will soon give way to biometrics, data security is a valuable life skill and should be taught early and built upon every year. The next big questions: How does facial recognition work? And, what are its consequences? I’m pretty sure data security is covered in AP CompSci but access to that kind of course is rare.

Great post,

Monty

Great points and isn’t it so true that we sometimes create that culture of fear of failure and looking dumb in a classroom. I think the best thing an educator can do is model the genuine learning to create a safe space to do so.